One asset is increasing, while another asset is decreasing by the same account. Since the petty cash account is an imprest account, this balance will never change and will remain on the balance sheet at $75, unless management elects to change the petty cash balance. When a petty cash fund is in use, petty cash transactions are still recorded on financial statements. The journal entry for giving the custodian more cash is a debit to the petty cash fund and a credit to cash.

For example, Tende Pay is a digital solution that enables decision-makers to have a 360-degree view of their operations, reducing traditional challenges faced by Kenyan businesses. The job of a custodian is to approve expenditures, maintain records, and request reimbursements for the fund when the remaining cash is low. Finally, surprise petty cash counts should be made to maintain good internal control over the fund. Another entry to petty cash is not made unless the firm wants to increase or decrease the fund above or below $100.

At all times, the balance in the petty cash box should be equal to the cash in the box plus the receipts showing purchases. Petty cash is stored in a petty cash drawer or box near where it is most needed. There may be several petty cash locations in a larger business, probably one per building or even one per department. The cash over and short account is an excellent tool for tracking down fraud situations, especially when tracked at the sub-account level for specific cash registers, petty cash boxes, and so forth. An examination of the account at this level of detail may show an ongoing pattern of low-level cash theft, which management can act upon.

If the balance in the petty cash account is supposed to be $75, then the petty cash box should contain $45 in signed receipts and $30 in cash. Assume that when the box is counted, there are $45 in receipts and $25 in cash. This creates a $5 shortage that needs to be replaced from the checking account. For example, a retailer will compare daily cash sales to the actual cash found in the cash register drawers.

Many small businesses will do this monthly, which ensures that the expenses are recognized within the proper accounting period. In the event that all of the cash in the account is used before the end of the established time period, it can be replenished in the same way at any time more cash is needed. If the petty cash account often needs to be replenished before the end of the accounting period, management may decide to increase the cash balance in the account. If, for example, management of the Galaxy’s Best Yogurt decides to increase the petty cash balance to $100 from the current balance of $75, the journal entry to do this on August 1 would be as follows. Balancing the petty cash account usually occurs when the fund needs to be replenished.

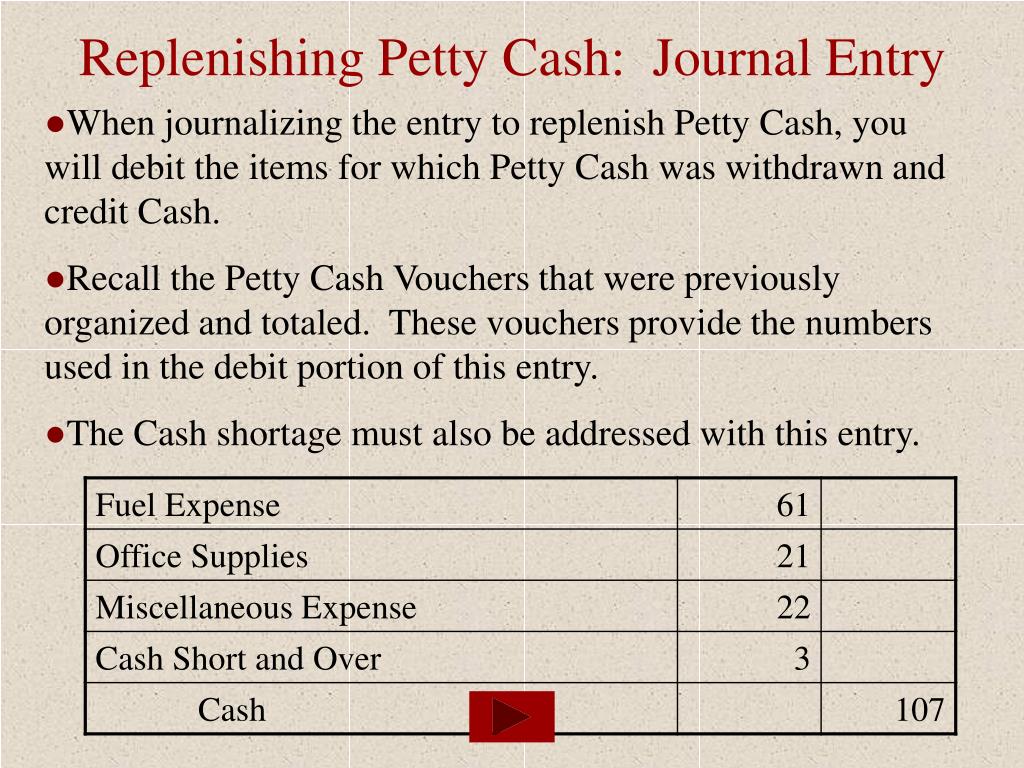

The petty cash custodian refills the petty cash drawer or box, which should now contain the original amount of cash that was designated for the fund. This is a credit to the petty cash account, and probably debits to several different expense accounts, such as the office supplies account (depending upon what was purchased with the cash). The balance in the petty cash account should now be the same as the amount at which it started.

Any costs resulting from theft, such as door or lock repair, can also be recorded as theft expense. If the management at a later date decides to decrease the balance in the petty cash account, the previous entry would be reversed, with cash being debited and petty cash being credited. Usually the petty cash account cash short and over is a permanent account. one individual, called the petty cash custodian or cashier, is responsible for the control of the petty cash fund and documenting the disbursements made from the fund. By assigning the responsibility for the fund to one individual, the company has internal control over the cash in the fund.

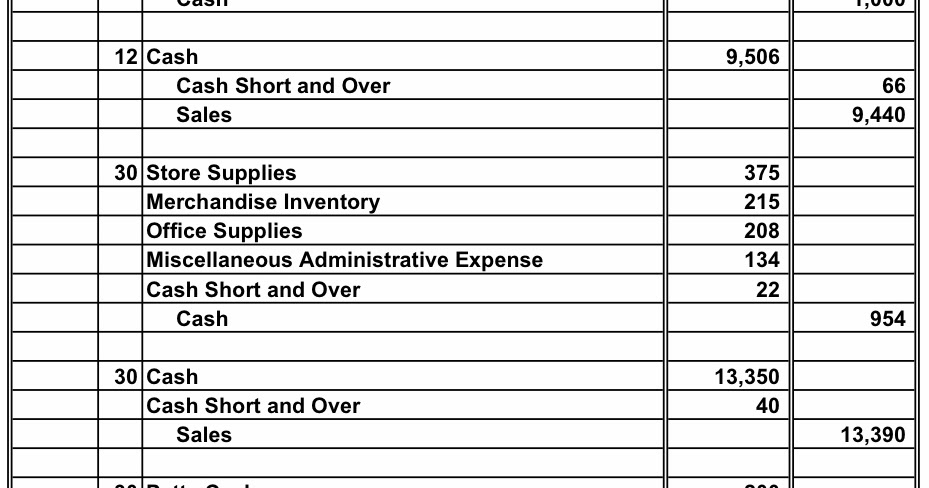

A company uses a cash over and short account to show a discrepancy between the company’s sales records and other reported figures and its audited accounts. For example, if the cash in the register is less than the amount on your sales receipts, then you have a cash shortage, reports Double Entry Bookkeeping. Cash over and short accounts are also used widely to balance the company’s accounting records when it replenishes its petty cash account.

For example, assuming that there is a $5 cash overage instead when we replenish the petty cash in example 2 above, which results in the petty cash reconciliation looking like the below table instead. The balance in the petty cash account is now $300, which is where it was originally authorized to be. On the downside, the convenience of petty cash can also make it a problem, and a risk. Cash is hard to secure and impossible to track; it’s very easy for bills to disappear without a trace—even if you’ve established a careful system of receipts or vouchers.